Cancelling or delaying the Keystone X.L pipeline could mean a $9-billion loss over 7 years on both sides of the border.

According to the Royal Bank of Canada Dominon Securities says the lost oil sands investment would hurt construction, engineering, project management companies among others.

It says because most of the proposed pipeline would be built in the United States, Canadian companies wouldn’t be affected as much.

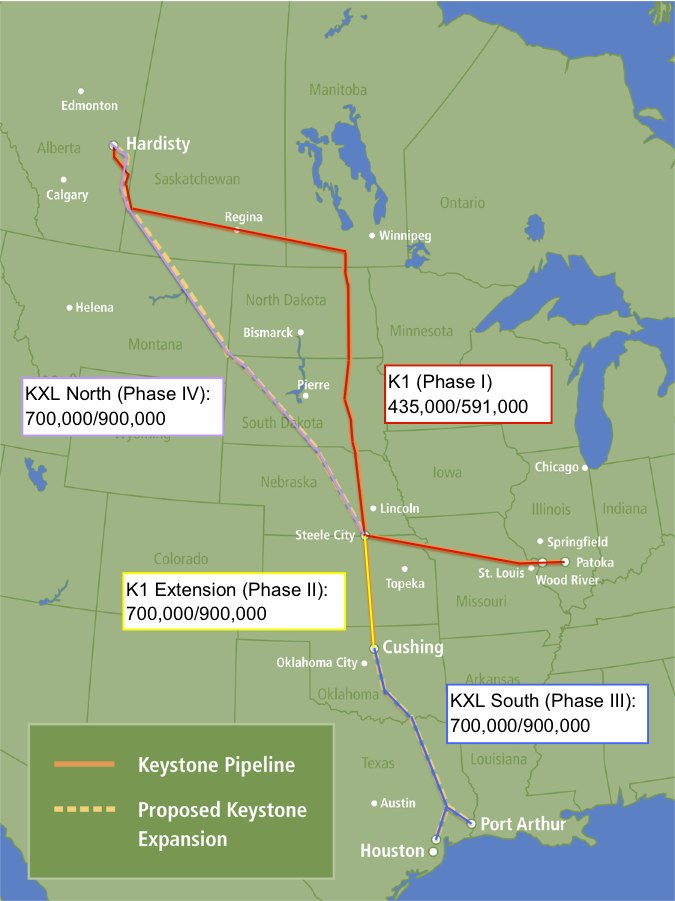

The proposed oil sands pipeline would ship 700,000 barrels of Alberta’s oil sands crude a day, through six states to refineries on the U.S Gulf Coast,

A decision on the line is expected from the Obama Administration this summer.

May 28th, 2013