The 2019 Property Tax Rate Bylaw was approved unanimously at Tuesday’s council meeting.

Last year’s tax ratio was 14.30 per cent, the 2019 ratio is 12.45.

The approval means a reduction for the majority of residents and an overall property tax reduction of $28 million.

“Growth in the rural non-residential tax class, continued focus on budget reductions and a strong fiscal management program has reduced the required property taxes from $672.2 million last year to $643.6 million in 2019.” said Philip Schofield, Regional Assessor.

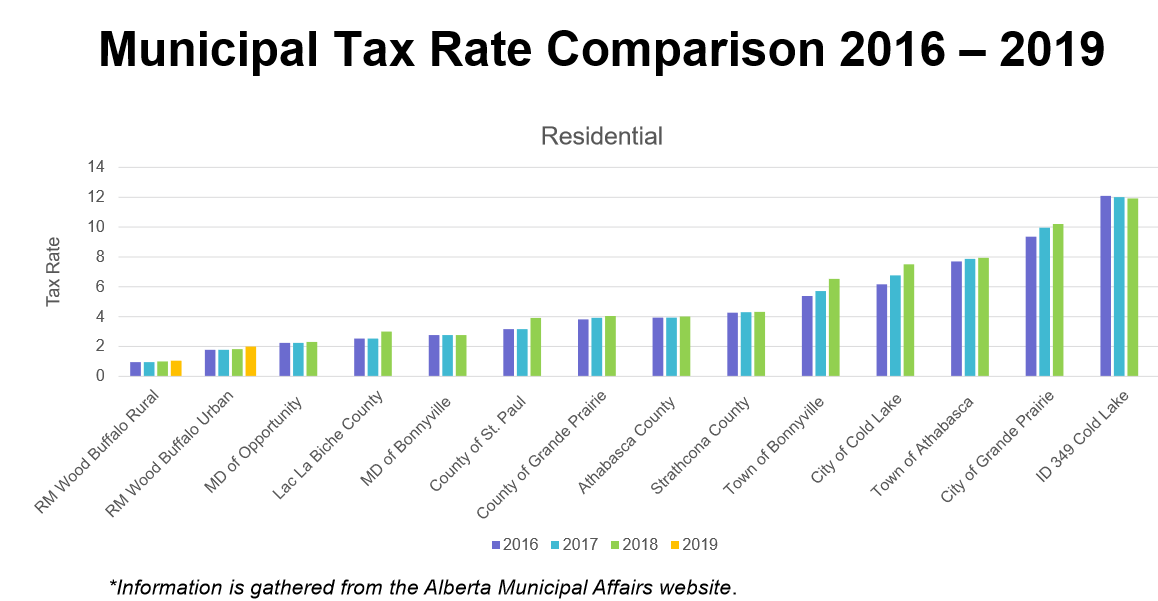

A municipal tax rate comparison presented to council shows that Wood Buffalo has had some of the lowest tax rates in the province in both residential and non-residential tax classes.

While urban and rural non-residential tax rates would experience an increase in taxes, last year council approved the creation of a “rural non-residential small business property sub-class” which gives approved properties a 25 per cent reduction from the rural non-residential rate.

The tax rate is calculated based on the total assessment value of properties within each tax class and makes up 87 per cent of the municipality’s total revenue.

Council also voted to allow a capital budget amendment of $1,191,000 for two projects.

Regional Emergency Services will relocate its 911 Emergency Communications Centre at a cost of $691,000, some of which will come from the 911 Grant.

The original project was to address concerns at Fire Hall # 2 and to modernize the system used by the 911 dispatch, but bids received in December 2018 were higher than budgeted.

An alternate location will be used to reduce the additional costs that would go along with renovations.

Anzac could see work being done soon on drainage issues after council agreed to put $500,000 towards the project.

The funding would go towards grading, drainage improvement work, the installation of storm pipes and landscaping.

To wrap up the night, council voted to have Mayor Don Scott send a letter to the Prime Minister and Minister of Finance to advocate that the federal government review the effects of the B20 residential mortgage stress test on regional markets and to eliminate or tailor regional-based policies.

Scott called B20 another example of a rule that isn’t helpful for our region.

While the actual number of how much the region has lost in assessed value wasn’t available Tuesday night, Schofield said a “typical” residential urban home has lost 25 per cent of its value over the last few years.

“What I’m concerned is that we’re contributing to a crisis by doing nothing and letting this continue on.”

Mayor Scott will also send a letter to the Premier and the President of the Treasury Board and Minister of Finance to advocate that Alberta Credit Unions and ATB Financial consider adopting Alberta-based mortgage approval requirements.

Council will meet again on May 14.